Traders must look into that more than go out, market feeling tends to Spin Rise sign up offer truthfully measure the separated entities’ standalone prospects, impacting inventory trajectories. Points for example administration’s proper rationale and you will market standards gamble a life threatening part in the shaping these types of long-identity style. Spinoff shares might be unpredictable in early period after an excellent the new business is composed. Yet ,, an excellent spinoff is frequently helmed by the enthusiastic officials and you can professionals which try encouraged to understand the value of their team as well as inventory arise and you may develop. The newest unstable rates step of a smaller sized, fast-growing spinoff’s inventory can mean the chance of destroyed well worth. Shareholders just who choose balances you are going to want to capture profits by the selling spinoff offers within the an enthusiastic uptrend and always hold the business shares.

„Spinoffs commonly a sure choice,“ says Jim Osman, inventor and you can chief executive of your Border Category, a firm dedicated to basic study from spinoffs and other special things. Joe Marwood is not an authorized money coach and nothing for the the website will be thought to be custom funding advice. It actually was a similar tale for carries in the Russell 3000 world in which inventory separated brings registered an excellent eleven.83% average come back versus 9.90% for all carries. In theory, a stock split up do absolutely nothing to alter the root value of a pals so it shouldn’t have any genuine feeling. A good organization’s administration you will suggest an excellent spinoff once they assume the new mutual worth of the new agencies individually will be higher than when the they continued to operate since the just one team.

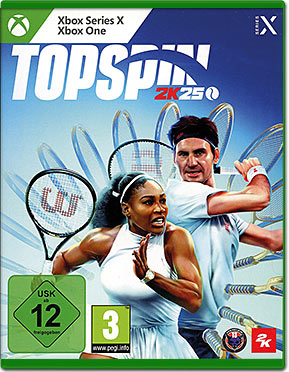

Spin Rise sign up offer | Unknown business

Recognizing challenges for example industry sounds and misinterpretation from very first reactions enhances evaluation precision for told funding choices. State law and also the laws of the stock transfers determine whether a buddies need find stockholder approval for a go-of. The brand new spin-of organization shouldn’t have to register the new shares of your spin-out of underneath the Securities Operate away from 1933 if it suits particular conditions. Spin-offs not merely wanted a distribution ratio to determine the matter of brand new shares becoming obtained, but a new Costs Allowance % is required to your mobile from prices basis. Which % changes the new for each display rates basis of one’s unique defense and you can establishes the newest per show costs foundation of one’s the new protection. A friends’s administration might highly recommend a great spinoff if they expect the brand new mutual worth of the newest organizations separately would be more than whenever they continued to run since the an individual company.

Income tax Outcomes out of an inventory Broke up

Investors obtained you to show of Philip Morris Around the world per show away from Altria it owned. That it chart reveals the common a dozen-month go back out of firms that merely revealed an inventory split compared to your S&P 500 list. Usually, companies that split up the stock provides have a tendency to outperformed the marketplace within the the brand new days one to implemented. Because the following graph, centered on investigation away from Bank out of The usa’s Lookup Investment Committee suggests, brings you to split defeat the newest S&P five-hundred typically because of the a critical margin within the each one of going back four many years. Complete, companies that separated its stock noticed an average complete return from twenty-five.4 % in the 1 year one to used the fresh statement out of their split. That’s more double an average get back of your S&P five hundred while in the those people symptoms.

Feeling of one’s spin-from

Winning spinoffs, such as PayPal, AbbVie, Yum China, Fits Classification, and you will Sales force.com, has shown the chance of well worth development and you can growth. However, it’s required to run thorough look and research just before committing to personal spinoff organizations. It’s important to remember that the process of a spinoff can be end up being advanced and date-consuming, related to judge, economic, and you can working factors. Organizations often do thorough planning and you can speak with legal and economic advisors in order to navigate this action successfully. SmartAsset Advisers, LLC („SmartAsset“), a wholly had subsidiary away from Economic Sense Technical, try registered to the U.S. It will not purport as over or to establish the newest tax effects that can affect kind of types of shareholders.

So why do Investors Including Spinoffs?

Knowledge whether or not the business provides overreacted otherwise underreacted is also notably effect funding procedures associated with spin-offs and you can divestitures. Spinoffs have a tendency to increase productivity to own shareholders because the recently independent companies is also best work at their specific products or services. A family is generally so higher that it’s not able to effectively and effectively manage a division so that it hits worth. In this case, a spinoff will help by permitting the newest mother or father team to put the operate to raised monetary explore. Enterprises perform a good spinoff for several factors, all of them grounded inside added monetary get back to your father or mother organization. Because the twist-out of, PayPal’s inventory speed features over tripled, when you are eBay’s stock speed features stayed relatively apartment.

This can impression information disseminated for the possibilities organizations and you may effect the way we gauge the moneyness of our own alternatives. It is important to know such change whenever we find ourselves in cases like this or even better, prevent them as much as possible (with the exception of inventory breaks). These types of markets represent but a few instances in which spinoffs have been commonplace.

Get Joined Tech, and that spun of a couple of separate companies, Otis Worldwide (OTIS) and you will Provider International Firm (CARR). Remember this is just a mental design, I’m not explaining exactly what actually happens when a dividend is actually paid back. However, which rational design is always to point your to the best answer, as the In my opinion it’s more straightforward to conceptualize the benefits splitting since the a chance-of. Sign up the registration membership now and you can gain access immediately in order to pro resources, like the common A week Stock Monitor & Watch Listing.